Over recent months, the global pandemic has shifted the rules of engagement for everyone, both professionally and personally. For many retail companies, doors continue to remain closed, demand for products continues to fade, and consumers are now categorizing products into either ‘essential’ or ‘non-essential’ buckets. Some Consumer Products companies (CPG) seem to be benefiting during this time as they continue to manufacture ‘essential’ products and distribute them effectively across all channels, including ecommerce. However, as the world starts to see the light at the end of a pandemic tunnel, how will this shift their CPG pricing strategy?

Waves of Pandemic Impact

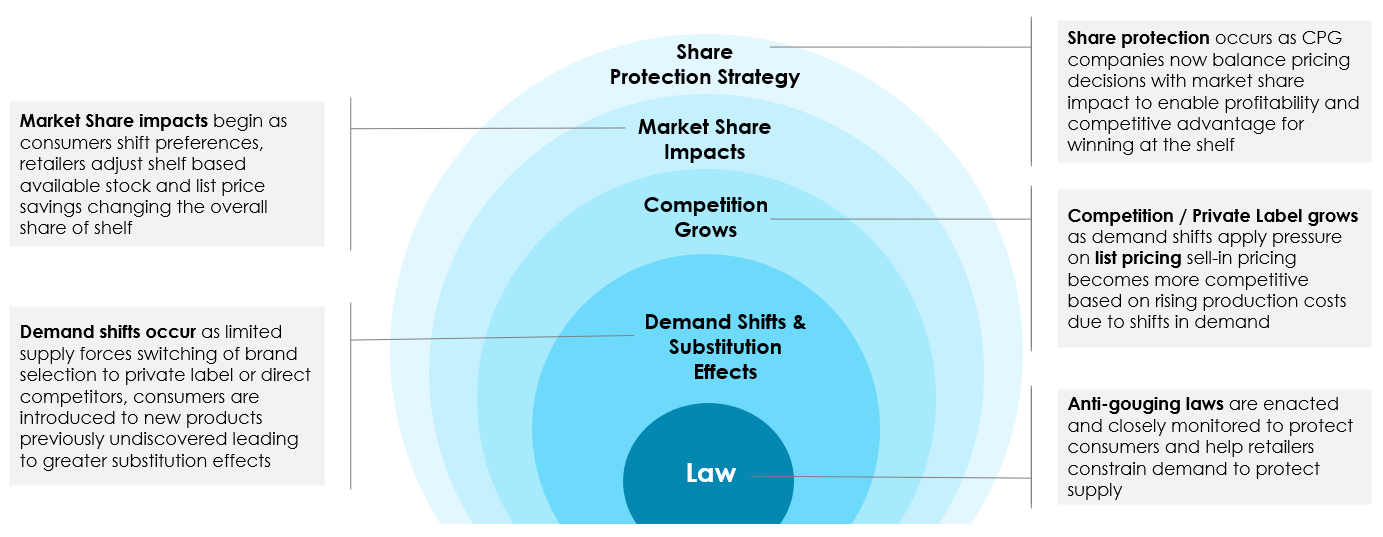

We are observing four rippling impacts of this pandemic that will ultimately affect CPG pricing strategy. These impact waves will dramatically change how CPG companies find sustainable profitability, channel leadership, and consumer loyalty, especially as these waves change the landscape of competitiveness.

#1 – Price Controlled by Legislation: The impact of legislation in the form of anti-price gouging laws and emergency price increase freezes will protect many consumers from significant jumps in consumer goods prices during this time. However, it will also create greater pricing pressure for CPG companies through an inability to ‘take price’ to offset increased costs due to raising demand from pantry loading and online purchase behaviors. These increased production costs will either drive lower margins as prices remain steady or reduce supply protection thereby impacting consumers in the form of out-of-stocks.

#2 – Demand Shifts Due to Supply Shortages: Limited supply and demand shifts open the door for new competitors for traditional national/household brands. The biggest competitor for many CPG companies will be private label manufacturers directly cannibalizing their category as consumers switch from out-of-stock national brands to local or retailer centric brands (e.g. Charmin vs. Target’s Up and Up toilet tissue). In addition, new market entrants, producing N95 masks for example, will begin to meet supply limitations and put pressure on CPG companies to lower price, if and only if, these new entrants are able to sustain supply at lower costs.

#3 - Competition Grows from Substitute Brands: More brand options lead to greater substitution effects when consumers shift to new products previously not purchased as the result of ‘forced discovery’ of quality at lower shelf pricing. These substitution effects cause changes of purchase behavior that influence the ‘share of shelf’ traditionally owned by national/household brands. As substitution opens the door for new competition, loss of valuable ‘share of shelf’ begins forcing CPG companies to think differently about their pricing strategy.

#4 – Recalibration to Protect Market Share: Ultimately, CPG companies will readjust their thinking about pricing and approach it as a strategic lever to protect market share - not just profitability.

New questions will arise, such as:

- Should I lower list prices to the customers (retailers) to protect my share of shelf and fight off competition?

- Can I absorb production costs and pass lower prices to end consumers to protect brand loyalty and product demand?

- How do I support retail channels trying to recover from economic crisis yet still protect my profitability?

Their ability to simply ‘pass price increases’ will become a thing of the past. Increased market competition from retailers seeking value sell-in pricing to encourage EDLP, and from significant demand shifts due to new product entry, will drive a more focused effort to sustain market share and demand for their own products. This new normal will focus on maximizing profits while maintaining share of shelf - a new balancing act not previously practiced. Driving profitability through price increases at the expense of sales unit loss will become a significant risk to profitability, market growth, and consumer relevancy.

Responding to the New Norm with a New Strategic Framework

As CPG companies emerge from the pandemic in this new retail landscape, the challenges are best addressed by leveraging advanced analytics and machine learning to create a strategic pricing framework that will:

- Segment products based on attributes, price, and consumer shopping behavior to identify new competitors and establish a clear view of direct competition

- Uncover demand transference by understanding substitution effects as a relationship of price, attributes, and demand shifts

- Invest in market share models that predict shelf share shifts as a function of their own price compared to their competitors’

- Balance profitability with market share impacts to optimize revenue, margin, and shelf share, taking into consideration input costs, business constraints like production run limitations, and marketing costs for share acquisition.

Market share models enable AI algorithms to discover how attribution, price indexing, and cross-effects shape demand and explain every percent change in price, the percent change in market share, and, most importantly, who wins or loses share in the market as collective demand shifts. These models are the key to understanding the full impact of pricing strategies on all dimensions of business outcomes. Leveraging this framework, along with sound pricing architecture and product innovation, will ensure consumer relevancy, differentiation, and value that will sustain CPG companies during uncertain times and give them a competitive advantage in years to come.