Fashion retailers have invested heavily to drive tighter assortments, dynamic allocations, and omnichannel inventory efficiency. But if a customer can't find her size, all that work is moot. In fact, the tighter the inventory, the more it exacerbates the size stock-out problem.

“If she can't find her size, then the inventory efficiency investments were meaningless.”

Size optimization, where store/size level demand forecasts are used to drive size-level order quantities, is not new. But prior methods have always had their flaws that people looked over. New technologies, a need for inventory efficiency, and alterations in consumer buying and fulfillment behavior have renewed this topic's importance.

Precise size-level order optimization is rare. Even sophisticated retailers with many state-of-the-art AI applications often rely on basic allocation math buried within older order management systems (OMS) to handle this last, crucial piece of inventory decisioning.

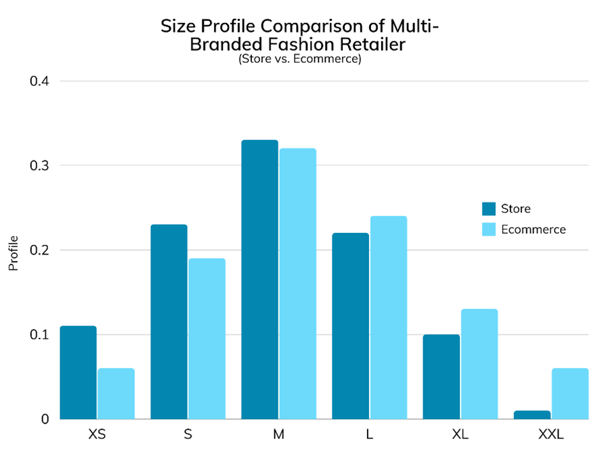

Those stale methodologies use last-year-based selling, basic min unit rules, or rules of thumb. Most systems that allocate style and style-color level orders rarely account for the significant difference in size profiles between neighboring stores and often ignore the size selling differences between eCommerce and stores.

The problem confronting size optimization is stark - The accurate determination of demand at a very sparse selling level: store/size.

Size Optimization needs the application of sophisticated demand forecasting and an ability to derive an accurate selling signal within the noisy selling data. In addition, like many optimization problems in retail, the need is to balance service level – being in stock on the needed sizes – with the cost of holding inventory. This is a strategic inventory decision, and any size optimization must provide efficient mechanisms to understand and adjust for this balance.

Complicating the matter further is that pack constraints and opportunities can impact ordering costs. Hence, size Optimization must consider pack quantity efficiencies as the determinate of final order quantities.

- To date, merchant experience with size optimization has been frustrating.

- Poor demand forecasts at a size level have led to imperfect sales imputation.

- Imperfect sales imputation has led to over-ordering of fringe sizes at the cost of lost sales for core sizes.

- Simplistic last-year-based size profiles do not handle new and additional sizes.

- New products and suppliers without a selling history cannot be modeled.

- Merchants have no efficient way of managing core business rules such as the designation of core sizes and coverage minimums.

The result has been demonstrably flawed size ordering and a high level of merchant over-rides of size level guidance.

The size of the problem is substantial, impacting margin, revenue, markdowns, inventory, and customer satisfaction. Models for the margin loss show that the lost margin adds up quickly with a relatively small % of misallocated size units. In a typical six-sized size range, misallocations of less than 20% of an order's units can drop margin dollars as much as 50% if markdown pricing is uniform across all sizes. Additionally, lost sales quickly accumulate as customers cannot find their size. A missed allocation of 17% of ordered units yields up to 23% fewer sales as stock-outs depress demand.

“A 20% size misallocation drops margin dollars by 50%.”

These numbers are meaningful, but the hidden cost comes in customer satisfaction. The investment in assortment and allocation, not to mention buying and marketing, all convert to a negative buying experience if she cannot find the item in the needed size.

So how can retailers achieve proper size optimization given all the challenges and constraints?

- Reliable forecasting that accounts for data sparsity

- Ensuring coverage without over-allocation

- Omnichannel incorporation

- Integration to ordering and inventory systems

- And effective user control

I will dive deeper into these points my next post.